Top Home Flipping Markets for 2016

One of the key factors driving growth in a number of the nation’s leading real estate markets is a lack of new construction. There are just not enough new housing units being built to keep up with demand from wave of millennial buyers who are ready and willing to purchase a move-in ready home thanks to a rebounding economy. As a result, home flipping has continued to be a solid investment option for real estate investors with a Self-Directed IRA or Solo 401(k).

One of the key factors driving growth in a number of the nation’s leading real estate markets is a lack of new construction. There are just not enough new housing units being built to keep up with demand from wave of millennial buyers who are ready and willing to purchase a move-in ready home thanks to a rebounding economy. As a result, home flipping has continued to be a solid investment option for real estate investors with a Self-Directed IRA or Solo 401(k).

A recent report released by RealtyTrac shows that home flipping transactions have reached a six-year high in the 2nd quarter of 2016, and that trends remain strong for this type of opportunity.

A Look at the Numbers

Following are some of the key data elements from the report:

- Home flips accounted for 5.5% of all homes sold in the 2nd quarter, up from 5.4% in Q2 of 2015.

- A total of 51,434 homes were flipped by 39,775 investors. The overall number is up 14% from the previous quarter, and the number of participants in the market represents a nine-year high dating back to 2007. These numbers include both institutional and individual investors.

- The average home flipped in the quarter sold for $189,000, which represents a 48.8% gross return based on an average initial purchase price of $127,000. The $62,000 average gross profit on these deals represents the highest level since the beginning of the data cycle in 2000, and a steady increase over the 47.5% average gross profit on flips in Q2 of 2015. As a key point of contrast, the average gross profit on flips in 2006 was just 27%.

- The most productive price range is for homes between $100,000 and $200,000, representing 35% of all flip transactions. The target home price appears to be shifting upwards, however, as the number homes in the $200,000 to $300,000 range that were flipped increased by 10% over a year ago.

- The average time to flip was 185 days. This represents a slight increase from the 180 day average in previous quarter.

Not mentioned in the report, but something we see as key to the continued strength of this opportunity is the solid availability of mortgage loans for retail homebuyers. Adding value to a property does you no good if you cannot sell, and the collapse of credit availability was what killed the flipping market in 2007-2008.

Top Markets

The RealtyTrac study identified the following as the top metropolitan markets for home flipping in 2016:

| City | Flips as % of overall home sales |

| Memphis, TN | 11.1% |

| Visalia-Porterville, CA | 10.1% |

| Tampa, FL | 10.0% |

| York-Hanover, PA | 9.7% |

| Mobile, AL | 9.6% |

| Fresno, CA | 9.5% |

| Lakeland-Winter Haven, FL | 9.5% |

| Deltona-Daytona Beach-Ormond Beach, FL | 9.4% |

| Clarksville, TN | 9.3% |

| Miami, FL | 8.6% |

Cash is King

While some credit is available for investors wanting to flip properties, 70% of flipped homes were purchased with cash. For investors using a self-directed retirement plan, this can be a big advantage. Most household savings are locked up in tax-sheltered retirement plans, and the ability to tap that source of capital for house flipping can present significant profit potential.

Seizing the Opportunity with your IRA or 401(k)

When putting your self-directed retirement plan funds to work in flipping, there are several things you need to consider to ensure you maximize the benefit to your savings while at the same time minimizing risk. This is a topic we covered in depth with a series of articles.

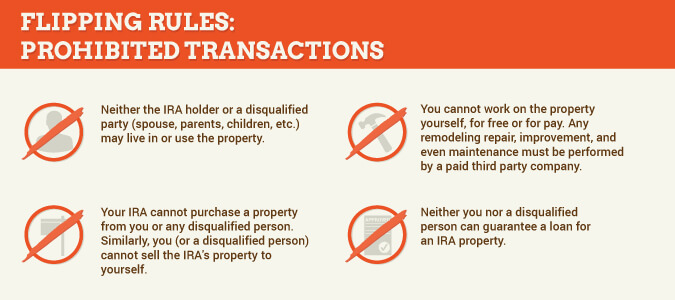

All plan transactions must be conducted at arm’s length and avoid disqualified parties. While you can identify opportunities and negotiate deals, and administer a plan transaction by signing contracts, paying for expenses and receiving income into the plan account, you cannot add value to the IRA through the provision of goods or services. Leave your tool kit at home when your IRA is flipping houses and hire unrelated professionals for all work.

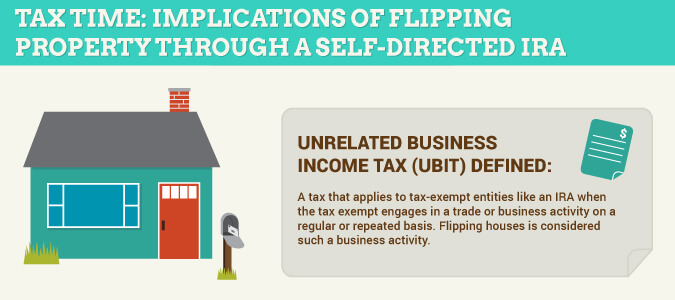

Flipping houses is something the IRS considers a trade or business activity, unlike passive investments such as holding rentals or collecting interest. As such, a trust tax known as UBTI (Unrelated Business Taxable Income) applies to an IRA when it engages in such activities on a regular or repeated basis. The trust tax rates can be high, and this tax cost can put a significant dent in the overall return to your IRA. That said, one simply needs to keep their eye on the expected net, after-tax return to the IRA and compare that to other alternatives the IRA may have to generate income. If you can flip a house and generate 35% return before UBIT, that still represents a net return to the IRA in excess of 21%. What else is your IRA doing that earns that kind of return?

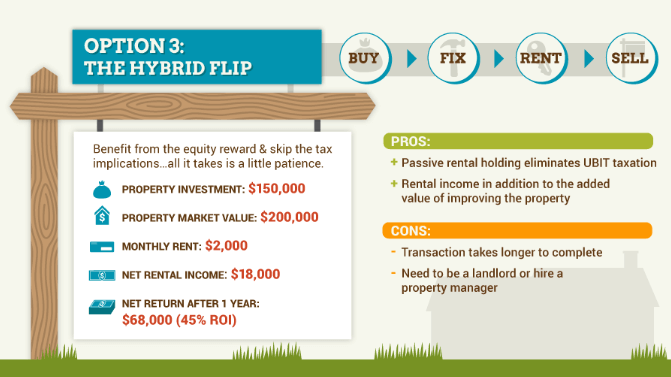

You can consider alternative approaches to put your Checkbook IRA or Solo 401(k) to work in the flip market, without having exposure to UBIT. If your plan lends money to another investor so that they can flip a house, the points and interest received by the IRA are passive income not subjected to taxation, for example. You can also execute what we refer to as a hybrid-flip, whereby the IRA purchases a property to fix up, but rather than immediately selling the property, holds it as a rental for at least a year. When the IRA sells in the future, this is no longer viewed as a flip, but rather as a reallocation out of passive real estate and into cash, with no tax implications. The added value of the flip is captured and represents a profit opportunity for your self-directed plan, but by delaying the sale, the tax burden is eliminated.

As a diversified investor with a self-directed IRA plan, it is important to understand the opportunities available in your specific market. For the last few years house flipping has been a prime choice, and that trend does not appear to be fading.

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.