Are My Funds Eligible for a Self-Directed IRA or 401(k)?

A self-directed IRA or Solo 401(k) is a great way to diversify your retirement savings into assets such as real estate, mortgage notes, private placements and the like. Investing in these types of assets requires a decent amount of capital, however, and that generally requires being able to transfer or roll over funds from an existing retirement plan.

Are your funds eligible to be rolled over to a self-directed IRA or Solo 401(k)? We’ve outlined some of the basic points so you can be sure.

One of the key things to keep in mind is that a self-directed IRA or 401(k) is no different than any other retirement plan when it comes to the back-end issues of compliance & reporting, rollovers, contributions, etc. The business model of investing with the plan is different, but the plan itself is just an IRA or 401(k) treated the same as any other.

Can I Move My Funds?

The first thing to ensure is whether the funds you intend to self-direct are eligible to be moved at all. In some situations, your funds may be locked into a current retirement plan and ineligible for transfer.

IRA

- Any IRA will be eligible for transfer. This includes Traditional, Rollover, Roth, SEP and SIMPLE IRA plans as well as inherited IRA’s. Whether various types of IRA are compatible and able to be consolidated is another issue covered later.

Former Employer Plan

- A qualified employer plan from a previous job will be able to be rolled over to a new plan. This includes 401(k), 403(b) 457, profit sharing, and pension plans as well as most state and federal government retirement plans.

Current Employer Plan

- Funds in a current employer 401(k) or similar qualified plan may not be able to be transferred.

- The tax code allows for “in-service distributions” whereby you can remove funds from a current plan while still employed. Most plan administrators, however, design their plans with only limited options for such in-service distributions.

- If you are still working with a company and have reached retirement age of 59 ½, a plan has to allow for an in-service distribution.

- There may be other factors such as length of employment, age of a threshold lower than 59 1/2 , etc. under which you can take an in-service distribution, but such flexibility is not common.

- In some cases, you may have eligibility for an in-service distribution, but only on the portion of your savings that has been fully vested.

- Funds you may have rolled into a current employer plan from a prior plan should be eligible for a rollover.

- Check, with your HR department or plan administrator to determine if your plan offers in-service distributions and if so, if you are eligible.

SIMPLE IRA (less than 2 years old)

- A SIMPLE IRA can be transferred to another tax-deferred IRA if the account has been in existence for more than 2 years. If a SIMPLE IRA is less than 2 years old, it can be transferred, but only to another SIMPLE IRA. You can establish a self-directed IRA as a SIMPLE IRA.

Are My Funds Compatible?

If you have multiple different existing retirement plans, it is important to ensure they are compatible with each other and can be consolidated.

If you have multiple different existing retirement plans, it is important to ensure they are compatible with each other and can be consolidated.

For the most part, funds that are held by the same owner and have the same tax status can be consolidated. Following are a few common examples:

Traditional IRA and Old 401(k) Plan: |

YES – Both plans are tax-deferred and accessible for transfer, so they could both be transferred to a new IRA/401(k). |

Roth IRA and Old 401(k) Roth Sub-Account: |

YES – Both plans have Roth status and are accessible for transfer. Both could be transferred to a new Roth IRA. |

SEP IRA & Traditional IRA: |

YES – Both are tax-deferred. These accounts could be consolidated into a new Traditional IRA, SEP IRA, or Solo 401(k). |

Traditional IRA and Roth IRA: |

NO – These accounts have different tax status and cannot be combined. |

IRA of Husband and Wife: |

NO – These accounts have different owners and cannot be combined. |

Traditional IRA and Inherited Non-Spousal Traditional IRA: |

NO – The inherited account has to be maintained separately as it will be subject to minimum distribution requirements. |

IRA Specific Considerations

IRA accounts are generally more flexible when it comes to transfers and rollovers. So long as funds are eligible for transfer and of the same ownership and tax treatment, they can be transferred into a single new self-directed IRA. The only exception is a SIMPLE IRA, which must be 2 years old before it can be transferred to a tax-deferred IRA other than another SIMPLE IRA.

Solo 401(k) Specific Considerations

A Solo 401(k) plan can hold both tax-deferred funds and Roth funds. Tax deferred funds from any eligible prior employer plan or IRA can be rolled over into a Solo 401(k) plan. When it comes to Roth funds, however, only the Roth sub-account of a prior employer 401(k) can be rolled over into a new Solo 401(k). An existing Roth IRA may not be rolled over into a Solo 401(k).

Within a Solo 401(k) it is possible to hold separate accounts for a husband and wife if both are employed by the company through which the plan is sponsored. While the funds are not “combined”, and must be tracked, valued, and reported separately, it is possible to combine these two separate accounts for purposes of making investments.

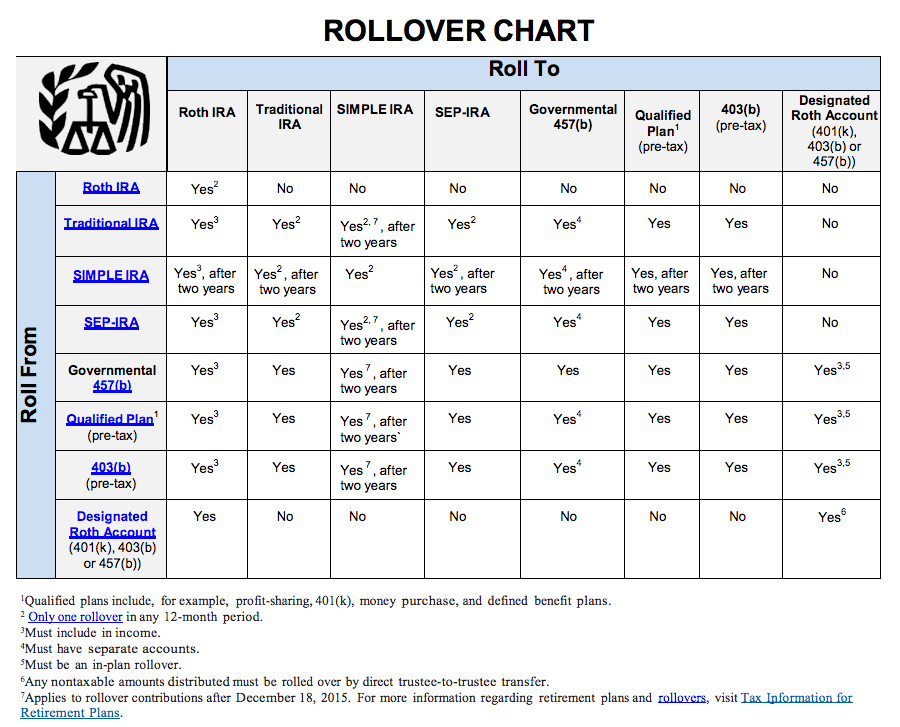

IRS Rollover Chart

Following is the IRS provided chart illustrating eligible rollover paths between plans.

Our team of consultants at Safeguard Advisors are experts on the topic of retirement plan rollovers. If you have questions about your situation, please feel free to contact us.