Self Directed IRA LLC

UNLOCK YOUR RETIREMENT PLAN USING A SELF-DIRECTED IRA LLC

A Self-Directed IRA LLC is a flexible retirement platform that allows you to fully diversify your portfolio with alternative assets

- A Checkbook IRA LLC is the most powerful and flexible means to grow your tax-sheltered IRA savings

- With a checkbook control account structure, you can have full authority over your self-directed IRA LLC investments

- Eliminate 3rd party paperwork, processing delays, and per-transaction fees

- Invest in real estate, private company stock, crowdfunding, private loans, cryptocurrencies and more with your self-directed IRA LLC

Talk to an Expert Today!

Schedule a Consultation Today!What is a Self-Directed IRA LLC?

A self-directed IRA LLC is a powerful and flexible retirement platform that allows for full diversification of investments into anything the IRS rules allow, and puts the IRA account holder in full control of all investment activities.

Through the use of a special purpose Limited Liability Company (LLC) this vehicle provides “checkbook control”. The LLC is wholly owned by the IRA, and therefore has the same tax-sheltered status as the IRA itself. You can serve as the manager of the LLC and direct the investment activities personally. LLC funds are held in a bank account of the your choosing, and all investment transactions take place from that account.

There are no taxes or penalties associated with changing a current IRA or 401(k) to a Checkbook IRA. This is still an IRA, and will have the same tax preferred status that all IRA accounts are afforded. A self-directed IRA LLC is simply a different model for investing, and a vastly superior tool for helping build retirement wealth.

A self-directed IRA LLC is also commonly referred to as a Checkbook IRA, Real Estate IRA or a Self-Directed IRA with Checkbook Control.

Invest in What You Know

With most IRA plans, your investment choices are limited to what the sponsoring firm sells – typically publicly traded stocks, mutual funds & bonds, insurance annuities, or bank CD’s. With an IRA LLC, you choose how the funds are invested and can select from a wide array of asset classes, including:

- Real Estate

- Private Company Stock

- Cryptocurrencies

- Tax Liens & Deeds

- Crowdfunded Ventures

- Oil, Gas & Mineral Rights

- Trust Deeds & Mortgages

- Private Loans to Businesses or Individuals

- Venture Capital

- Conventional Stocks, Bonds & Mutual Funds

- Anything the IRS Rules Allow

The IRS prohibits investments in collectibles (artwork, jewelry, stamps, etc.) and life insurance. Everything else is possible.

This flexibility provides you with the ability to invest in what you know. You can leverage your expertise and network to put your IRA to work in your own community and grow your retirement savings with confidence.

How does a IRA LLC Work?

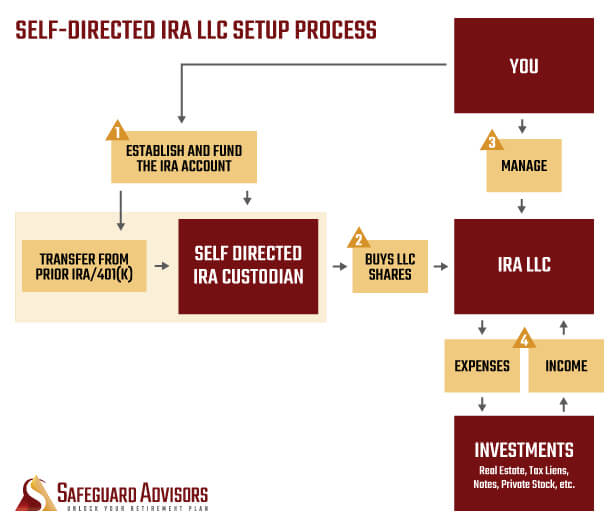

The flexibility and control offered by the Safeguard Checkbook IRA LLC comes from a unique design featuring two layers:

- A self-directed IRA account held by a registered trust company as custodian

- A specially crafted Limited Liability Company (LLC) wholly owned by the IRA

All IRA accounts require a custodian by rule. In this structure the custodian serves the necessary compliance and reporting role, but is passive in nature and very much in the background. All investment transactions take place within the LLC. You will only interact with the IRA account for purposes of adding or removing IRA capital in the future; such as making contributions, taking distributions, or rolling over funds between this and another IRA plan.

The LLC functions as your own personal IRA asset-holding company. The IRA is the 100% owner of the LLC. The IRA cash is invested into the LLC and remains under the umbrella of the IRA for reasons of tax treatment. You can serve as the non-compensated manager of the LLC and will have signing authority on behalf of the entity. This allows you to direct the capital of the IRA-owned LLC into the investments you choose.

It’s kind of like having a more conventional IRA invested into a mutual fund – but you get to be the fund manager.

You are In Control

Once the plan is in place, you are 100% in control.

- You will choose the bank or brokerage that holds the funds

- You will make investment decisions, negotiate, and execute contracts on behalf of the plan

- You can initiate an investment or pay expenses simply by writing a check, using a debit card, or wiring funds

- Income from investments is deposited directly to the LLC account

- There is no requirement for 3rd party review of paperwork

- There are no transaction fees or processing delays when making or maintaining investments

Take action right now!

Call 877-229-9763 to TALK to an EXPERT TODAY!

Top Quality Advisory Services – Your Key to Success

Establishing the plan is only the first step. How you use the plan is what matters when it comes to building your retirement savings safely and successfully.

At Safeguard Advisors, our team of investment, real estate, and legal professionals is uniquely capable of providing the full range of ongoing consulting services you need to invest with confidence.

As a client of Safeguard Advisors, you have ongoing, unlimited access to our team so long as you are using the plan – at no additional cost. You will have a dedicated consultant who is a seasoned investor to help guide you as you take control of your retirement portfolio. If you want to understand the IRS guidelines surrounding a particular transaction strategy, learn how to use the power of leverage within your IRA, or just want help making your annual IRA contribution, we’ve got you covered.

Since 2005, we have implemented thousands of self-directed IRA plans for investors in all 50 states. Through dedication to excellent service for each and every investor we work with, we have earned an A+ rating with the BBB.

Take action right now!

Call 877-229-9763 to TALK to an EXPERT TODAY!

Answers to Your Questions

YES…In 1974, Congress passed the Employee Retirement Income Security Act (ERISA). making IRA, 401(k) and other retirement plans possible. Only two types of investments are excluded under ERISA and IRS Codes: Life Insurance Contracts and Collectibles (art, jewelry, etc.). Everything else is fair game. IRS Code Sec. 401 IRC 408(a) (3)

It‘s really quite simple. Government regulators decided the Securities industry was best suited to inform the public and bring these new products to market. From the beginning, brokers and bankers created the misconception that buying stocks, bonds and mutual funds was all that was allowed. It wasn’t true then…and it’s not true now. You can probably guess why they kept it a secret.

Many types of existing retirement plans may be rolled over to a self-directed IRA. Firstly, funds must be eligible for rollover. Most any IRA may be rolled over at any time. A 401(k) or similar employer retirement plan from former employment can be rolled over. A current employer retirement plan may not be eligible for rollover. A self-directed IRA may only hold funds of one tax type, but can be configured using any IRA type such as Traditional IRA, SEP IRA, SIMPLE IRA or Roth IRA. You can even self-direct an inherited IRA.

No. There are no taxes associated with moving to a self-directed IRA. A self-directed IRA is still an IRA, just with a different business model for investing and more choices of asset classes.

We’ll take you through a simple, step by step process designed to put your investment future into your own hands…immediately. Everything is handled on a turn-key basis. You take 100% control of your Retirement funds legally and without a taxable distribution.

Talk to An Expert Today!

Learn these little known strategies and tactics and unlock your retirement plan today.