IRA Rollover & Transfer of Funds

The process of moving existing retirement funds from one plan to another is referred to either as a rollover or transfer. There are specific IRS rules that govern what types of funds can be moved between various plans and the methods of executing and reporting on fund movement. Generally speaking, you can move funds from one plan to another and still retain the tax sheltered status of the funds. Most clients establishing a self directed IRA or Solo 401(k) will initially fund their new plan with a non-taxable transfer or rollover from an existing plan. There are 3 common methods of moving funds between plans.

IRA Transfer

A transfer describes the process of a direct, institution-to-institution transfer of like-kind IRA funds. Following are several examples:

- You can transfer a Traditional IRA at one institution to a new or existing Traditional IRA held by a different provider.

- A Roth IRA can only be transferred to another Roth IRA.

- Because the accounts on both ends have the same tax-deferred status, you can also transfer between employer IRA plans like a SEP or SIMPLE and a Traditional IRA.

- SIMPLE IRA accounts cannot accept inbound transfers from non-SIMPLE accounts, however, and may only be transferred to a non-SIMPLE account after the SIMPLE account has been active for two years.

A transfer is typically initiated by filling out paperwork with the receiving IRA custodian. They will then request the funds from the current institution. Because the funds are not distributed to the account holder, but rather go direct to the receiving plan, there is no tax implication and no tax withholding is required. There is no limit on the number or frequency of such direct transfer transactions.

Direct Rollover

A direct rollover occurs when funds are moved between different plan types, and are directly issued from the source plan to the receiving plan. The most common example is when one rolls over a former employer 401(k) or other qualified plan to an IRA.

Because the funds are not distributed to the account holder, but rather to the receiving plan, there is no tax implication and no tax withholding is required.

It is common for 401(k) and pension administrators to issue a rollover check to the new plan, but mail the check to the account holder, who then must forward the check to the receiving IRA custodian. Even though you might “handle” the funds, they are not viewed as having been distributed to you.

There is no IRS limit on the number or frequency of such direct rollover transactions. However, many 401(k) and pension administrators have their own policies limiting the number of rollovers you can execute per year, or may require that you rollover all funds and close your account in certain situations.

Indirect Rollover (60-Day Rollover)

An indirect rollover is a process whereby funds are distributed from the source plan to the account holder and then deposited to a new retirement account within 60 days. Because of the initial distribution to the account holder, there are specific rules regarding such events that must be followed closely. Failure to follow these rules will result in the amount being viewed as a taxable distribution with the addition of a 10% penalty for taxpayers under age 59 1/2. Funds absolutely must be deposited into a qualified retirement plan before the 60 day period expires. They can be deposited to the source plan, a new plan, or a different existing plan.

The tax treatment of the receiving plan should generally be the same as the source plan, though is is possible to combine a rollover from a tax deferred account with a conversion to Roth status.

Some source accounts – namely most qualified plans – will require that 20% be withheld for taxes. This really complicates the process of re-depositing funds, as you will need to come up with that 20% out-of-pocket, and will then get it back at tax time.

IRS rules limit such indirect or 60-day rollovers to one such transaction per taxpayer per 12-month period.

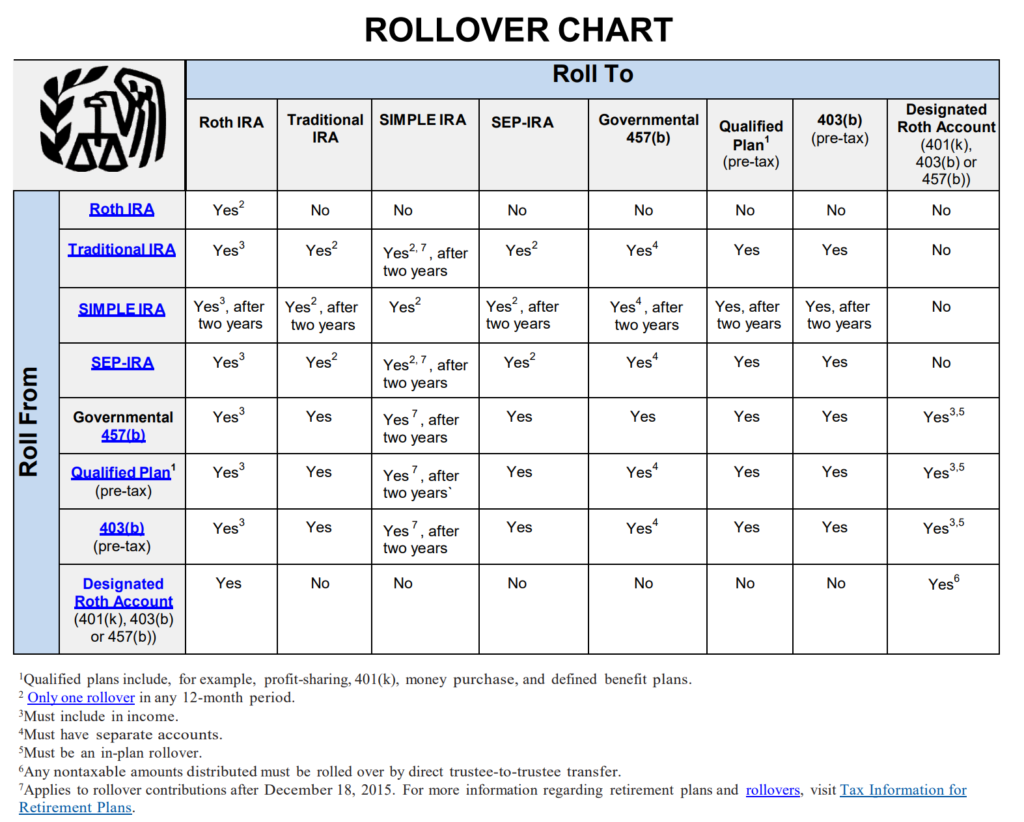

Rollover Chart

The Rollover Chart below comes directly from the IRS website. It’s a good tool for determining which types of retirement plans are eligible to be rolled from one plan to another.

click to view the full-size chart

click to view the full-size chart

The above chart can be viewed on the IRS Website. The IRS also provides good information on this topic in the memo Rollovers of Retirement Plan and IRA Distributions.

Current Employer 401(k) Plans

In most all cases, you cannot rollover funds from a current employer 401(k) or other qualified employer plan if you are under age 59 1/2. After age 59 1/2, a current employer must allow you to take an “in-service” distribution from your plan, and you can choose to roll this over to another plan such as a self-directed IRA. Some plans may allow for in-service distributions with other conditions such as length of service at ages younger than 59 1/2, but this is rare. If you are unsure, ask your plan administrator.

Roth Conversions

A Roth Conversion occurs when funds in a traditional IRA or other tax-deferred retirement account are changed to tax-free Roth status. In many cases, a Roth conversion will be performed as part of a rollover transaction, though you can also convert an account in-place. If you intend to both rollover funds between plans and perform a Roth conversion, take care to ensure you fully understand the tax implications and the administrative process of the transaction so it can be executed properly.

Additional Considerations for Self-Directed Plans

So long as you follow the rules for proper routing, reporting, and timing of plan-to-plan transfers or rollovers, you can enjoy great flexibility in allocating your retirement portfolio to the appropriate plan.

You can establish a Checkbook IRA and transfer only those funds you intend to invest in non-traditional assets at the current time. In the future, you can transfer more funds if you choose to allocate more of your portfolio to real estate, for example.

You can also transfer earnings from real estate or other non-traditional investments back to a traditional IRA held with a brokerage.

Help When You Need It

The experts at Safeguard Advisors fully understand the various rules surrounding plan-to-plan transfers and rollovers. We are also quite familiar with the administrative requirements of most of the common IRA custodians and plan administrators. If you have questions about whether your funds can be moved, or if you need help actually getting funds moved into your Safeguard self directed plan, we are here to help. We’ll make the process as easy as possible and ensure that all guidelines are followed so as to keep your funds tax-sheltered.