Solo 401k

TAKE CONTROL WITH A SELF-DIRECTED SOLO 401K PLAN

A Self-Directed Solo 401(k) Account is the Best Way For Business Owners to Save For Retirement.

- A Solo 401(k) — also known as an Individual 401(k), Owner 401(k) or Self-employed 401(k) — is the favored option for successful business owners to save for their retirement future

- Diversify your retirement portfolio and have more control over your investments

- Contribute to your plan on a pre-tax (Traditional) or post-tax (Roth) basis

- Invest in real estate, private company stock, crowdfunding, private loans, cryptocurrency and more with your self-directed solo 401(k) account

Talk to an Expert Today!

Schedule a Consultation Today!What is a Self-Directed Solo 401(k) Plan?

A 401(k) plan is an employer sponsored retirement savings plan established per provisions of the US tax code. Such plans first came into existence following the enactment of the Employment Retirement Income Security Act of 1974 (ERISA).

A Solo 401(k) is a relatively new iteration of this type of plan dating to 2001 and passage of the Economic Growth and Tax Relief Reconciliation Act (EGTRRA). This law increased the contributions available to the self-employed version of the 401(k) and generally streamlined the administration of such plans.

Since its introduction, the Solo 401(k) has become the favored option for successful business owners to save for their retirement future, and offers many advantages over options such as SEP IRA’s, SIMPLE IRA’s and Keough plans. For self-employed investors who qualify, this is our recommended plan of choice.

Income from the sponsoring employer may be contributed to the plan on a tax-deferred or Roth basis. Contribution limits are more generous than with IRA based plans, potentially as high as $67,500 per participant.

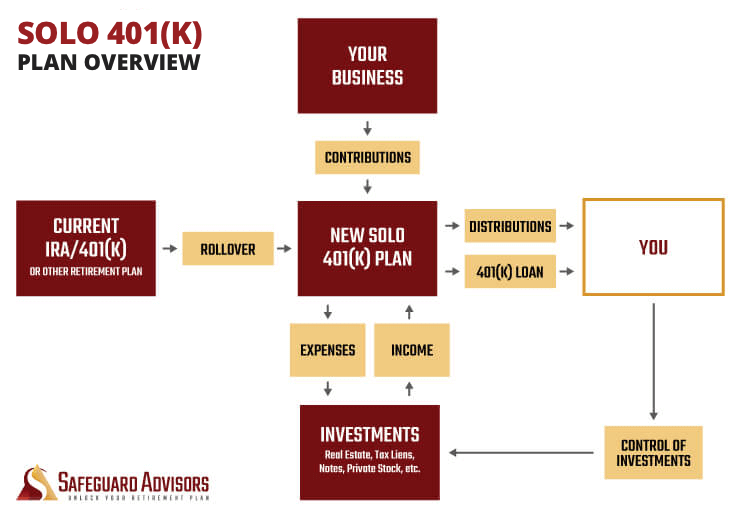

Many types of existing retirement plans such as IRA accounts or former employer 401(k) plans can be rolled over into a Solo 401(k), without taxes or penalties. All investments made with the Solo 401(k) will have the same tax-preferred status as any other similar retirement plan.

This type of qualified retirement plan is also sometimes referred to as an Individual 401(k), Owner 401(k) or self-employed 401(k).

Take action right now!

Call 877-229-9763 to TALK to an EXPERT TODAY!

Invest In What You Know

With most IRA or 401(k) plans, you are limited to investing in what the plan provider sells. Since most institutions that provide such plans are Wall Street brokerages, that means stocks, bonds and mutual funds. If you want to invest in real estate or stock of a privately held company, they typically cannot help you because is it just not their business model.

With a Safeguard Advisors Solo 401(k) you control the plan and can directly make plan investments. This means your plan can invest in a truly diversified fashion. Options include:

- Real Estate

- Private Company Stock

- Tax Liens & Deeds

- Oil, Gas & Mineral Rights

- Crowdfunded Ventures

- Cryptocurrency

- Trust Deeds & Mortgages

- Private Loans to Businesses or Individuals

- Venture Capital

- Traditional Stocks, Bonds & Funds

The IRS prohibits investments in collectibles (artwork, jewelry, stamps, etc.). Everything else is possible.

This flexibility gives you the opportunity to invest in what you know. You can put your retirement savings to work in your own community, and tap into your network and experience to invest with confidence.

How Does a Solo 401(k) Work?

The 401(k) plan itself is a specialized retirement savings trust. As the self-employed business owner, you serve as the trustee of the plan, and have control over how the plan is managed. Rather than have your plan administered by a generic financial services firm with limited investment options, you can self-administer the plan and therefore invest as you choose.

As part of the plan setup process, you will establish one or more accounts for your 401(k) plan with a bank and/or brokerage house you select. That institution, however, will not be providing any 401(k) related services or have control over how the plan is invested. They will simply be holding a trust account for which you – the plan trustee – have full control.

As the trustee and plan administrator, you have the direct ability to put your 401(k) savings to work. When a good investment opportunity comes along, you simply execute the contracts and fund the transaction from the 401(k) trust bank account. All expenses associated with the acquisition and maintenance of investment assets are paid from the plan account, and all income produced by those investments is returned to the trust account. Income from investments is tax-sheltered under the umbrella of the Solo 401(k).

You are In Control

Once the Solo 401(k) plan is in effect, you are 100% in control.

- You select the bank or brokerage for your plan

- You select the right opportunities and execute contracts on behalf of the plan

- You pay for investments and related expenses simply by writing a check, using a debit card, or wiring funds

- Investment income is deposited directly to the 401(k) trust account

- No 3rd party review of paperwork is required

- There are no processing delays or per-transaction fees associated with investment activities

Take action right now!

Call 877-229-9763 to TALK to an EXPERT TODAY!

Safeguard Solo 401(k) Features & Benefits

- A powerful savings and investment plan for self-employed business owners who qualify

- Your spouse can participate if they are employed by the business

- A truly self-directed retirement plan with checkbook control

- Generous contribution limits up to $67,500 per year per person ($135,000 for a husband and wife)

- Roth sub-account for tax-free savings

- Borrow up to $50,000 from your plan with a participant loan

- Not subject to UDFI taxation when using non-recourse mortgages to purchase property

- Simplified administration. No formal reporting required for plans under $250,000 in total value.

Visit the related topics below to learn more about Solo 401k eligibility, contribution limits, Roth savings and participant loans.

Top Quality Advisory Services – Your Key to Success

At Safeguard Advisors, our goal is your investing success. That means not only implementing your plan promptly and professionally, but more importantly, being available to help you maximize the potential of your plan with quality guidance.

Our team of real estate and legal professionals have the expertise necessary to help you invest with confidence.

As a Safeguard Advisors client, you have access to our team as long as you are using the plan – at no additional cost. Your personal consultant will be here to help guide you as you take control of your retirement portfolio, and will be bringing years of real-world experience in this field to the table. If you want to unlock the power of leverage within your Solo 401(k), have questions about IRS guidelines surrounding a particular transaction strategy, or just want help making your annual 401(k) contributions, we’ve got you covered.

Since 2005, many thousands of clients from all across the country have relied on Safeguard Advisors for self-directed plan services, and we strive hard each day to earn and keep the trust of every investor we work with. We have earned an A+ rating with the BBB as a result.

Take action right now!

Call 877-229-9763 to TALK to an EXPERT TODAY!

Answers to Your Questions

YES…In 1974, Congress passed the Employee Retirement Income Security Act (ERISA). making IRA, 401(k) and other retirement plans possible. Only two types of investments are excluded under ERISA and IRS Codes: Life Insurance Contracts and Collectibles (art, jewelry, etc.). Everything else is fair game. IRS Code Sec. 401 IRC 408(a) (3)

It‘s really quite simple. Government regulators decided the Securities industry was best suited to inform the public and bring these new products to market. From the beginning, brokers and bankers created the misconception that buying stocks, bonds and mutual funds was all that was allowed. It wasn’t true then…and it’s not true now. You can probably guess why they kept it a secret.

A Solo 401(k) requires a sponsoring employer in the format of an owner-only business. If you have a for-profit business activity – whether as your main income or as a side venture – and have no full time employees other than potentially your spouse, your business may qualify. The business may be a sole-proprietorship, LLC, corporation or other entity type. Learn more.

A Solo 401(k) can accept rollovers from many retirement plan types. Firstly, funds must be eligible for rollover. Most any IRA may be rolled over at any time. A 401(k) or similar employer retirement plan from former employment can be rolled over. A current employer retirement plan may not be eligible for rollover. Any tax-deferred retirement plan such as an IRA, SEP IRA, or old 401(k) may be rolled into the Solo 401(k). The Roth portion of a prior employer 401(k) may also be rolled. A Roth IRA may not be rolled into a Solo 401(k). Learn more.

We’ll take you through a simple, step by step process designed to put your investment future into your own hands…immediately. Everything is handled on a turn-key basis. You take 100% control of your Retirement funds legally and without a taxable distribution.

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.