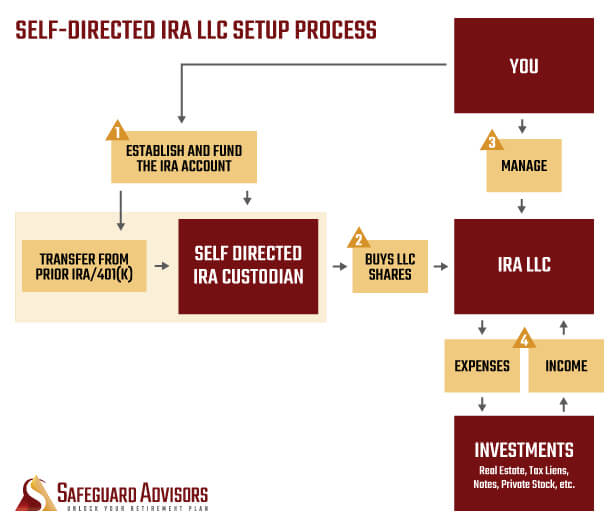

Self-Directed IRA LLC Setup Process

Our team at Safeguard Advisors will have your Self-Directed IRA LLC setup and funded in about 3-4 weeks, depending on the state of LLC formation and how responsive your current retirement plan administrator is to the request for transfer.

Our full-service plan setup process includes:

- Consultation to help design your plan specific to your situation and investment goals

- Assistance with the establishment and funding of your new self-directed IRA account

- All state and federal filings necessary to implement the LLC entity in the most appropriate state

- Specially tailored, custodian-approved, and IRS-compliant LLC operating agreement prepared by our legal team

- Assistance with the establishment your LLC checking account.

- Coordination of the funding transaction from the IRA to the new LLC account

- Ongoing access to high quality support at no additional charge

Laying the Right Foundation

Before we even get started, we will work with you to determine the optimal format for your IRA LLC structure. The LLC needs to be formed in the most appropriate state, which depends more upon how you will invest than where you live.

We’ll also help you plan the initial funding of your new Checkbook IRA LLC. The IRA LLC can accept funds from a variety of retirement plans such as former employer 401k, pension or other qualified employer plans, and all types of IRA plans such as Traditional IRA, Rollover IRA, Roth IRA, SEP IRA and SIMPLE IRA. You can also setup a plan using an inherited IRA. Not all types of IRA plans are compatible with each other however, and may not be able to be consolidated into a single IRA LLC.

How the IRA LLC Process Works

There are two components of the IRA LLC program:

- A self-directed IRA held by a Solera National Bank as IRA custodian

- The specially formed LLC created by Safeguard Advisors

1 – Creating Your Special-Purpose LLC

Our first step is to create your IRA LLC entity.

We will perform all necessary state filings, obtain a tax ID (EIN) for the LLC, and draft your custom IRS compliant LLC operating agreement.

2 – Establishing IRA and LLC Checking Accounts

Once the LLC is registered, our team at Safeguard will assist with the establishment of your IRA and LLC checking accounts at Solera National Bank.

3 – Funding

The funding of the IRA will be initiated once the IRA is setup, and may occur via rollover from a qualified plan, transfer from one or more IRA accounts, new contributions to the IRA, or some combination of the above.

You do not have to move all of your funds at once. We’ll help you determine what initial funding level makes sense based on your investment goals and current plan structure.

Keeping your IRA Funds Safe

During this entire process, your retirement savings is secure. Solera Bank is regulated in the same fashion as any other bank or brokerage that holds IRA accounts. They just have a different business model that allows for investments such as the special purpose LLC we are creating.

Cash in your IRA or LLC checking account is FDIC insured up to $250,000, just as with any other IRA account.