How to Protect Your Assets with a Self-Directed IRA LLC – Part 2

In a recent article we discussed the critical layer of asset protection afforded by the Checkbook IRA LLC structure. While it is great that the LLC entity in this plan format shields the IRA and the IRA account holder from claims or liabilities associated with investments of the LLC, what about those investors who may have a portfolio of multiple assets?

In a recent article we discussed the critical layer of asset protection afforded by the Checkbook IRA LLC structure. While it is great that the LLC entity in this plan format shields the IRA and the IRA account holder from claims or liabilities associated with investments of the LLC, what about those investors who may have a portfolio of multiple assets?

The IRA LLC structure will not provide protection across multiple investments. If a lawsuit results in a claim against the LLC, any of the assets of the LLC could be used to satisfy a judgment.

Fortunately for those investors seeking protections for a larger, diversified portfolio, there is an easy solution. The concept is referred to as asset segregation.

Asset Segregation

Asset segregation is achieved by placing any risk-bearing asset in its own entity. This shields other assets from the liability produced by that single asset.

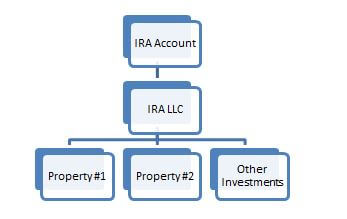

Non-Segregated Structure

In this example, the out-of-the box IRA LLC is used to hold all assets within the client’s portfolio. The IRA account owns the LLC. The LLC holds all investment assets. A judgment against the LLC could potentially attach all assets of the LLC.

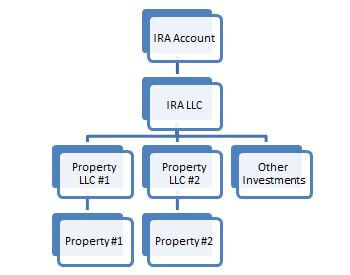

Segregated Structure

In this example, the IRA LLC is not used to hold title directly to real property assets that may come with associated liability exposure. Instead, the IRA LLC holds the ownership of a secondary LLC that will in turn be used to hold the real estate asset.

If someone were to successfully sue and obtain a judgment against property #1, only the assets of Property LLC #1 would be exposed. Other assets of the IRA LLC such as Property #2 LLC, cash, stocks, etc would be sheltered through the limited liability protection of Property #1 LLC.

The secondary, “property” LLC can be a simple LLC formed by the investor or a local legal resource, as this LLC is not required to have the IRS related language special to the IRA LLC we create at Safeguard Advisors. The member of a secondary LLC is the IRA LLC. The IRA account holder or someone they choose to designate may serve as manager for a property LLC. Each property LLC would need to have its own distinct bank account and insurance policy. All of this, however, is under the umbrella of the single IRA account and its ownership of the “master” IRA LLC for reasons of IRA tax treatment and compliance with IRS rules related to prohibited transactions.

Additional Considerations

Another option is the use of a Series LLC in some states. Overall, we are not convinced this is as beneficial as advertised. There is very little case law to support the cell segregation concept of a series LLC. Additionally, many states such as Nevada charge the same fees for each cell of a series as they would for a standalone LLC.

Quality insurance coverage is often your best first line of defense, and may be all the protection you really require.

Some investors may be partnering with others into a real estate transaction. So long as the partner is not a disqualified person to the IRA, this is simple to do. In the segregated LLC example, a property LLC may be partially owned by the IRA LLC and partially owned by a partner.

Before you choose how to structure your investment platform, you should consult with your legal advisor. Every investor’s circumstance is unique and many factors such as the overall size of a portfolio, the type and location of investment property, insurance coverage, etc., will factor into determining the most suitable solution for your specific needs.

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.