Solo 401(k) Plans

Solo 401(k) plans are self-directed retirement plans designed for small-business owners who have no full-time employees (other than self or spouse). These plans may be self-administered by the business owner, making him or her the “trustee” and thereby eliminating the need to engage a third party to handle administration or investments.

A solo 401(k) plan is a great investment tool that provides a wide range of investment choices, as well as checkbook control, which means you have the decision making power regarding how your funds are invested. These plans also offer other excellent retirement savings features such as high contribution limits, a Roth savings component, and the ability to personally borrow from your plan. The Solo 401k is the best option if you are self-employed and would like to maximize contributions to your retirement plan or take advantage of the loan provision.

Learn more about the power and flexibility provided by the Solo 401(k) plans in this section of our blog, with useful articles to help you make the best decisions for your retirement funds and your financial future.

A Solo 401(k) is a fantastic way for small business owners to save for retirement. With high contribution limits typically ten times those of an IRA, both tax-deferred and Roth savings features, and even the ability to borrow from the…

A Solo 401(k) is a fantastic retirement plan for self-employed individuals. With high contribution limits, both tax-deferred and Roth savings, and full control over investment choices, it provides one of the best ways to prepare for your golden years. There…

We are excited to roll out a big change that will greatly streamline the bank account setup process for new checkbook IRA and Solo 401(k) plans. Starting June 1, 2023, Safeguard Advisors will offer concierge banking setup with Solera National…

A self-directed Solo 401(k) provides a great amount of flexibility when it comes to investing your retirement savings. As part of designing your plan to best suit your investing goals, it pays to give consideration to the structuring of financial…

Entrepreneurs who are looking to start, acquire, or grow a business often consider using retirement funds. For many people, their 401(k) or IRA may represent their largest amount of savings. There are three ways you can access retirement funds to…

A self-directed Solo 401(k) is a great retirement plan. With high contribution limits and the ability to invest in anything the IRS rules allow for like real estate and private equity, the Solo 401(k) is one of the best ways…

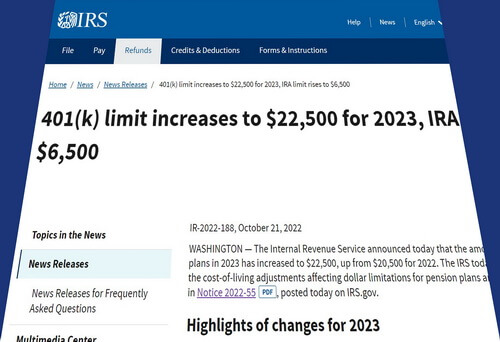

The IRS on October 21st announced updates to IRA and 401(k) contribution limits for the 2023 tax year. The increases are some of the biggest in years and impact all investors from those with a contributory IRA to participants in…

A self-directed Solo 401(k) is one of the best retirement plan options for independent entrepreneurs. With a self-directed Solo 401(k), you can invest in anything the IRS rules allow for, including real estate, venture capital, cryptocurrency and more. Being able…

One of the benefits of the Solo 401(k) is the ability to borrow from the plan. As a qualified employer 401(k), a Solo 401(k) can issue a participant loan — just like a larger employer 401(k) style plan. For the…

A Self-Directed Solo 401(k) plan is a fantastic way to save for your retirement future. With a self-directed plan you can protect and grow your nest egg with a wide variety of investment types like real estate, venture capital, and…