3 Tips to Hold Your Property Manager Accountable [CHECKLIST]

Imagine your ideal experience as a long-term rental property owner: rents flow in, repairs get made, costs are minimized, solid tenants move in and stick around, when something does go wrong it’s quickly dealt with.

Sound impossible? Achieving top performance from your IRA rental property is within your grasp. All you need is a good property manager.

Effective property management can mean the difference between a lucrative rental property and a struggling one. The first step is to find the right property manager—someone who is on the same page as you and will look out for your property over the long haul. The next step is to learn how to manage your property manager.

As the rental property owner, it’s your job to ensure things are being run according to your expectations. The more skilled you are at managing this relationship, the more easily you’ll be able to spot property managers who don’t meet your standards. And when you do land a good one, the right oversight from you can inspire even better service than a hands-off owner might receive.

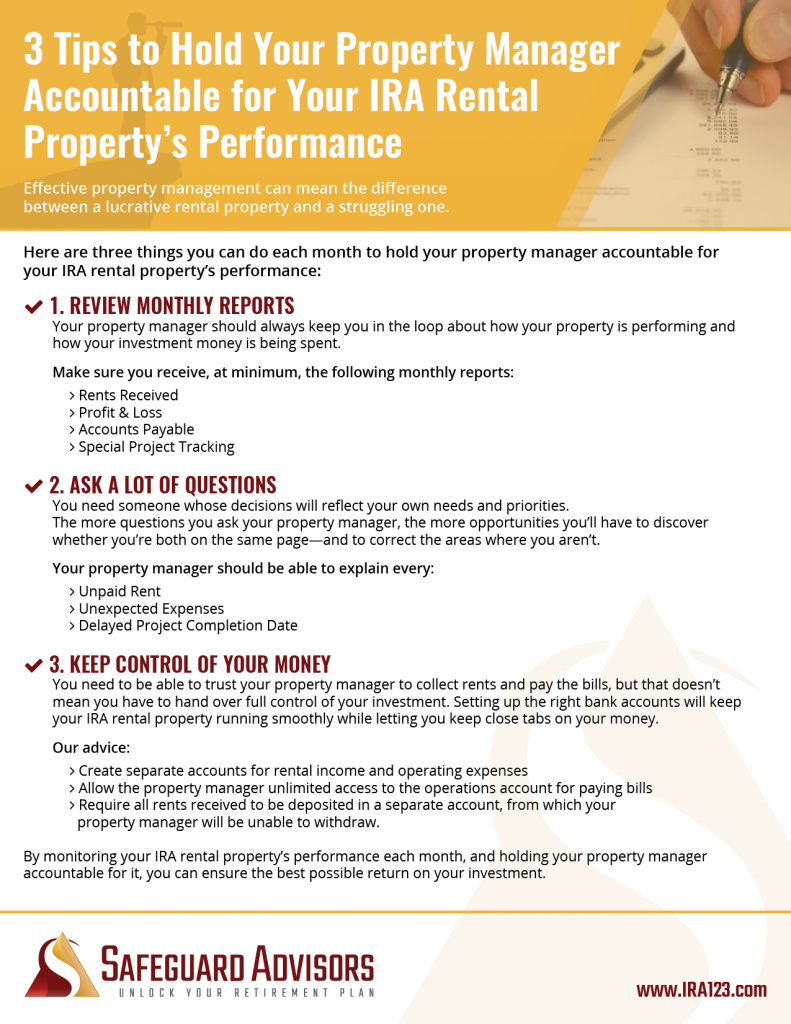

Managing your rental property manager requires some attention, but it doesn’t have to be labor-intensive. Here are three things you can do each month to hold your property manager accountable for your IRA rental property’s performance:

Review monthly reports.

Communication is the linchpin of a successful owner-manager relationship. Your property manager should always keep you in the loop about how your property is performing and how your investment money is being spent.

This information will also tell you a lot about how your property manager is performing. To gauge the effectiveness of both, make sure you receive, at minimum, the following monthly reports:

Rents received. Perusing a snapshot of all the rents collected and owed for the month will let you know whether your manager is collecting rents on time and evicting tenants when necessary.

Profit & loss. A summary of the month’s revenues, expenses and costs will show you where your money is going. Always make sure it lines up with the amount your IRA actually receives that month.

Accounts payable. Keeping track of all debts still owed on your property at the end of the month allows you to monitor whether your bills are getting paid on time.

Special project tracking. Whenever your property undergoes repair, renovation or other special work, you should also receive reports showing estimated project costs, how your funds have been spent to date and anticipated completion dates for each phase. These will tell you when you can expect to see a profit again.

Ask a lot of questions.

A property manager is, to some degree, empowered to make decisions about your property on your behalf. You need someone whose decisions will reflect your own needs and priorities. The more questions you ask your property manager, the more opportunities you’ll have to discover whether you’re both on the same page—and to correct the areas where you aren’t.

As you browse your monthly reports, take note of anything out of the ordinary and ask about it. Your property manager should be able to explain every:

- Unpaid rent

- Unexpected expense

- Delayed project completion date

Asking questions not only holds your property manager accountable, but it also tells you a lot about what excuses he or she considers acceptable from tenants, contractors and suppliers. If the two of you aren’t in agreement about what’s acceptable, say so immediately.

Keep control of the cash.

You need to be able to trust your property manager to collect rents and pay the bills, but that doesn’t mean you have to hand over full control of your investment. Setting up the right bank accounts will keep your IRA rental property running smoothly while letting you keep close tabs on your money.

Create separate accounts for rental income and operating expenses. Allow your property manager unlimited access to the operations account for paying bills, but require all rents received, late fees and other income to be deposited into a separate account, from which your property manager will be unable to withdraw. Any deposits into the operations account should require your authorization, which you can give once you’ve reviewed the monthly reports.

While it might be tempting to sit back and let your property manager handle everything, smart investors know a little oversight goes a long way. By monitoring your IRA rental property’s performance each month—and holding your property manager accountable for it—you can ensure the best possible return on your investment.

Take a look at our checklist below and download the PDF.

Photo by jamie brelsford via FreeImages.com Content License

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.