How to Estimate Your Rental Property Expenses [CHECKLIST]

In our previous blog, 4 Rental Property Expenses to Expect, we talked about what kind of expenses to expect when you invest in a rental property with your self-directed IRA or Solo 401(k). Making thorough calculations before you decide to invest in real estate is one of the most important things you can do to ensure the success and profitability of your investments.

In our previous blog, 4 Rental Property Expenses to Expect, we talked about what kind of expenses to expect when you invest in a rental property with your self-directed IRA or Solo 401(k). Making thorough calculations before you decide to invest in real estate is one of the most important things you can do to ensure the success and profitability of your investments.

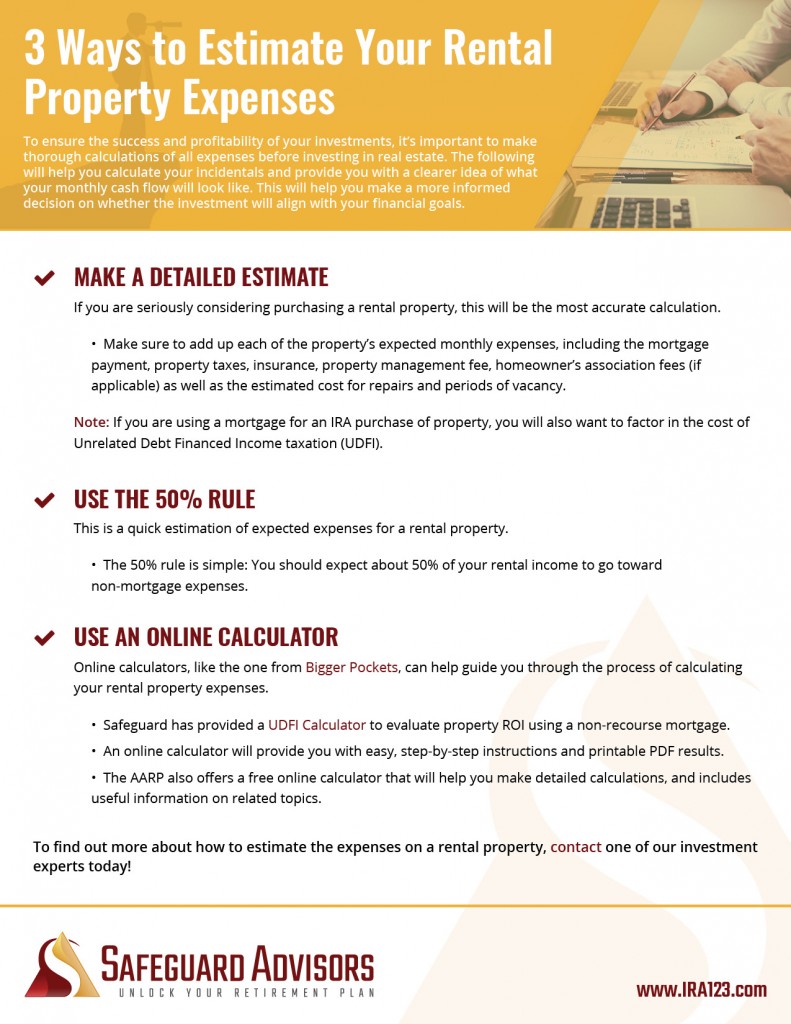

In this post, we are going to discuss three ways you can calculate those expenses in order to get a clearer picture of your what your monthly cash flow on a rental property will look like, which will help you decide if the property you want to purchase will fit your financial goals.

Make a Detailed Estimate

This method is more accurate, and should be used when you are seriously considering purchasing a rental property. It requires some up-front legwork, but accurate calculation of the expenses and cash flow is absolutely crucial when you are considering investing your retirement capital in a rental property.

This method is more accurate, and should be used when you are seriously considering purchasing a rental property. It requires some up-front legwork, but accurate calculation of the expenses and cash flow is absolutely crucial when you are considering investing your retirement capital in a rental property.

First, calculate the property’s expected monthly income (gross income). This is the asking rent for the property, the rent the current tenants pay, or the current market rent value for the property.

Once you have that number, calculate the property’s expected monthly expenses. These will be property taxes, insurance, property management fee, mortgage if applicable, homeowner’s association fees, and the estimated cost for repairs and periods of vacancy. If you are using a mortgage for an IRA purchase of property, you will also want to factor in the cost of Unrelated Debt Financed Income taxation (UDFI).

Our UDFI calculator can help you estimate not only the tax cost of using debt-financing, but also the overall profitability of an income property in an IRA. You can also compare the ROI of an all cash purchase to that of a leveraged purchase.

Next, subtract your monthly expenses from the monthly rent (gross income). This will give you your expected net income for the property, which you can compare with your financial goals and needs when you are deciding whether or not you want to invest in that property.

Use the 50% Rule

The 50% rule is a good way to do a quick estimation of the expected expenses of a rental property, which will help you predict the potential cash flow. Keep in mind that the actual expenses and cash flow of a property can vary depending on a number of factors, so it is most useful as a screening tool to determine whether a property is worth spending time examining further. The 50% rule is simple: You should expect that around 50% of your income on a property will go toward non-mortgage expenses. For example, if the property rents for $1200 per month, it will likely take about $600 per month to pay its expenses (not counting mortgage payment). If the mortgage is $400 per month, your monthly cash flow will be about $200 per month.

Use an Online Calculator

Many investment websites offer a number of valuable online tools for self-directed IRA and solo 401(k) investors who are looking into purchasing real-estate property. We like the handy online calculator from BiggerPockets, which guides you through the process with easy, step-by-step instructions, and allows members to create printable PDFs from their results. The AARP also offers a free online calculator that will help you make detailed calculations, and includes a lot of useful information on related topics like depreciation rates and annual operating expenses.

Download our checklist below for more information on estimating rental property expenses

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.