6 Prohibited Transactions to Avoid with Self-Directed IRAs [CHECKLIST]

One of the principal benefits of self-directed IRA and Solo 401(k) accounts is their flexibility, which allows for investments in diverse asset classes. With this added flexibility, however, comes added responsibility. It is important to understand IRS guidelines for the use of IRA funds, and to work with an experienced advisor who can help you navigate the ins and outs of investing with your IRA.

One of the principal benefits of self-directed IRA and Solo 401(k) accounts is their flexibility, which allows for investments in diverse asset classes. With this added flexibility, however, comes added responsibility. It is important to understand IRS guidelines for the use of IRA funds, and to work with an experienced advisor who can help you navigate the ins and outs of investing with your IRA.

If you do your homework, you can use your IRA or Solo 401(k) to the best advantage without placing your hard-earned retirement savings at risk for penalties from the IRS. In this post, we will review the six types of transactions that are prohibited for your self-directed IRA so that you know what to avoid when building your investment strategy.

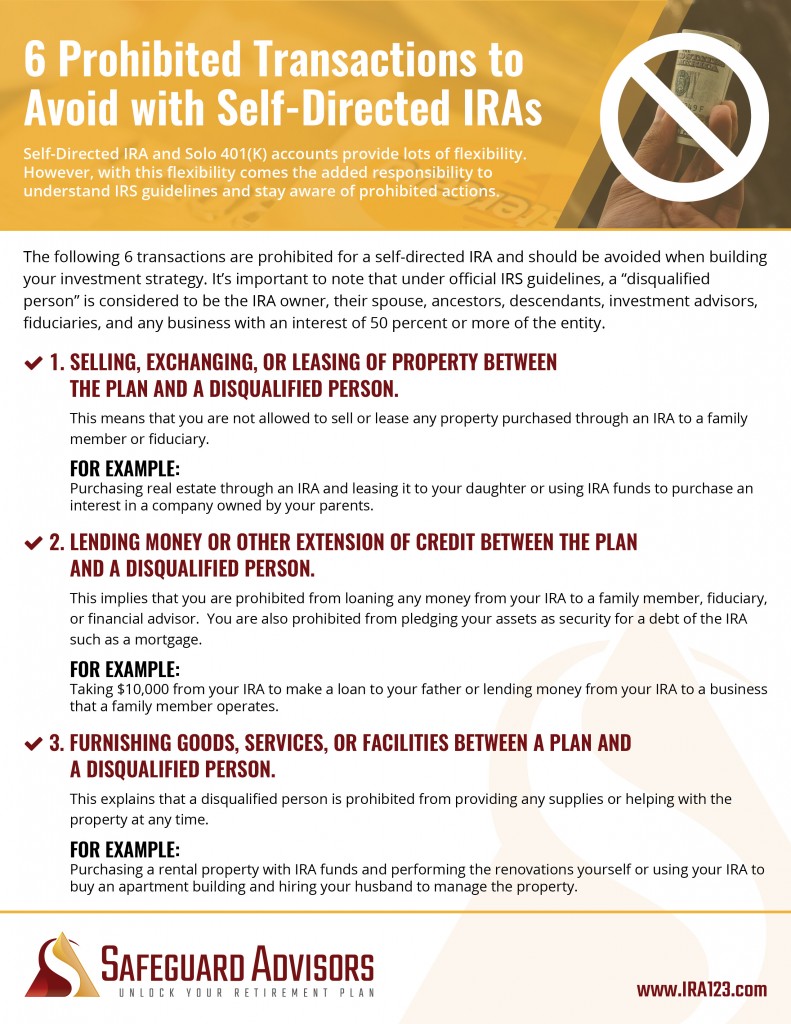

Generally, the IRS requires that any investing you do with your IRA or Solo 401(k) must be done at arm’s length and purely for the benefit of growing your tax sheltered retirement savings. The rules regarding these kinds of investments can be found in IRC 4975(c)(1) and IRS Publication 590, which define the types of transactions that are prohibited for IRA and Solo 401(k) investors. These transactions fall into the direct and indirect categories, and usually involve “disqualified persons.”

Under these guidelines, a disqualified person is: the IRA owner, their spouse, ancestors (parents, grandparents), lineal descendants (children, grandchildren) and their spouses, investment advisors, fiduciaries providing services to the plan, and any entity like a business or trust in which disqualified persons have an interest of 50 percent or greater or executive control of the entity. Below, we’ve outlined these prohibited transactions along with some examples to help clarify what they might look like.

Prohibited Transactions

- Selling, exchanging, or leasing of property between the plan and a disqualified person.

Examples:

- Noah purchases real estate with his IRA and leases the property to his granddaughter.

- Lydia uses her IRA funds to purchase an interest in an LLC owned by her mother.

- Lending money or other extension of credit between the plan and a disqualified person.

Examples:

- Evie uses $10,000 from her IRA to make a loan to her father.

- Walter lends $50,000 from his IRA to a business his son-in-law owns and operates.

- Mike borrows money to purchase a rental property with his IRA and puts a personal guarantee on the loan.

- Furnishing goods, services, or facilities between a plan and a disqualified person.

Examples:

- Nick buys a rental property with his IRA funds and personally performs the renovations.

- Jennifer uses her IRA to purchase an apartment building and hires her husband as the property manager.

- Transferring IRA income or assets of to a disqualified person, or using the plan’s income or assets for the benefit of a disqualified person.

Examples:

- Desdemona uses funds from her IRA to pay off her daughter’s student loans and credit card debt.

- Arthur uses his IRA to invest in a real estate fund for which he acts as manager and receives a salary.

- Dealing with the plan’s income or assets by a disqualified person who is a fiduciary (trustee or money manager) acting in his or her own interest or for his or her own account.

Examples:

- Preston hires his wife to provide administrative services for his IRA and pays her a fee.

- Irma is a real estate agent. She uses funds from her IRA to purchase a property and receives a commission from the sale.

- A fiduciary who is a disqualified person receiving any consideration for her/his own personal account from any party dealing with the plan in connection with a transaction involving the income or assets of the plan.

Examples:

- Glory manages a hedge fund and her management fee is based on the fund’s total assets. She uses her IRA to invest in the hedge fund.

- Deacon uses funds from his IRA to lend money to a business where he works in order to obtain a promotion.

The above examples are just that, examples. Should the IRS determine to audit your account, they would look at the facts and circumstances of how you have interacted with the funds to determine if a prohibited transaction has occurred.

Your best defense is to keep your IRA very much separate from your personal finances and to keep good records.

Download the Full Prohibited Transactions Checklist Here

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.