Real Estate vs. Stocks—Why Real Estate Wins: Part 2 [CHECKLIST]

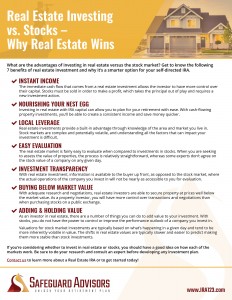

In our first blog in this two-part series, we talked about why investing in rental properties can be a better strategy for deploying your self-directed retirement plan capital than risking it in the stock market. We also covered some of the advantages real estate has over stocks, such as providing the kind of returns you are looking for, allowing you to take more control of your investments, and much more. In part two, we will examine more of those benefits and hopefully, help you make the best informed decisions when it comes to investing your IRA or 401(k) capital. Download our checklist, which covers the 7 benefits of real estate investment and why it’s a smarter option for your self-directed IRA.

In our first blog in this two-part series, we talked about why investing in rental properties can be a better strategy for deploying your self-directed retirement plan capital than risking it in the stock market. We also covered some of the advantages real estate has over stocks, such as providing the kind of returns you are looking for, allowing you to take more control of your investments, and much more. In part two, we will examine more of those benefits and hopefully, help you make the best informed decisions when it comes to investing your IRA or 401(k) capital. Download our checklist, which covers the 7 benefits of real estate investment and why it’s a smarter option for your self-directed IRA.

Investment Transparency

It is always the best policy to obtain as much information as you can before you invest. With real estate investment, the information is all available to you up front, as opposed to the stock market, where the actual operations of the company you invest in will not be nearly as accessible to your scrutiny. Since you are able to inspect any property before you purchase it, there is much more transparency in real estate, and if you find something irregular you can renegotiate your offer with the seller (as long as you do this within the inspection contingency timeline specified in your offer).

Buying Below Market Value

As a direct investor in real estate, you have more control over transactions and negotiations than when purchasing stocks on a public exchange. With good research and negotiations, you can secure property for your IRA or 401k at prices well below current market value. The condition of the property or the financial situation of the seller can present an opportunity to “make money when you buy” in real estate.

Adding Value…

As an investor in stocks, you have no control over the underlying asset and cannot improve the performance outlook of a company you invest in by any of your own actions (unless of course you are a billionaire activist investor). Real estate has a huge advantage over stocks because you can do any number of things to add value to your investment. You can add bedrooms, add bathrooms, finish basements, update the kitchen, or even install solar panels. Any work you do on your investment property will produce a tangible increase in value.

…and Holding Value

Stock market based investments are inherently volatile in value. Share valuations tend to be based on what is happening in today’s news rather than on the business reality of the company, they are prone to erratic swings and unpredictable performance. Real estate values do tend to shift as well, but these shifts are slower, more cyclical in nature, and easier to predict, which makes them more stable. Unless you are forced to sell, a dip in value for a property is not so big a concern if the rental income remains solid.

Take a look at our checklist below about Real Estate Investing

and download it here.

Photo by Philipp via CC license

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.