Investing in Rental Property vs. Notes in a Self-Directed IRA [CHECKLIST]

Rental property and private mortgages are some of the most popular investments for Self-Directed IRA and Solo 401(k) plans. As we speak with several hundreds of investors each month and participate in online investor forums, we are frequently asked which of the two is the better option. The reality is that there is no single right answer, other than maybe “both”. That said, we felt that outlining some of the key pros and cons of each approach would be a valuable exercise.

Rental property and private mortgages are some of the most popular investments for Self-Directed IRA and Solo 401(k) plans. As we speak with several hundreds of investors each month and participate in online investor forums, we are frequently asked which of the two is the better option. The reality is that there is no single right answer, other than maybe “both”. That said, we felt that outlining some of the key pros and cons of each approach would be a valuable exercise.

Investing in Rental Property

Rental property is a great asset for building retirement wealth. Your plan funds are invested into a real asset that has intrinsic value – providing a level of security not found in many asset classes. Real estate has the potential to create income both with monthly cash flow and appreciation in property value over time. One can also use mortgages to acquire real estate with an IRA or 401(k) plan and take advantage of the higher cash-on-cash returns that leverage provides.

Real estate is an asset class that most of us understand and are comfortable with. Many of our self-directed IRA investors have experience as landlords already. Understanding a particular real estate market and the potential and risks within that market, while somewhat complex and fluid, is a lot more linear than the multiple variables that can impact other investments such as equities. Real estate does go through cycles, but those cycles can be a lot easier to predict and do not come with the inherent volatility of financial markets. Being able to invest locally in an asset class you understand is a big plus.

On the down side, rental property requires tenants to pay the rent. Finding and retaining quality tenants requires skill, and a bit of luck thrown in. Managing tenants can be frustrating, and there is always the specter of damage to the property, vacancy between tenants, and even litigation. If you happen to have experience as a landlord, then being able to self-manage your properties. Otherwise, it may be best to hire a professional property manager. Either way, you have to put effort into the ongoing operating of a rental property investment to ensure the highest chances of success and profitability – either in managing tenants or managing the property manager.

Investing in Notes

Notes are also a type of investment that can produce excellent and consistent returns and boost the value of your tax-sheltered retirement savings. Notes come in many types, but the most common are those secured by real estate in the form of a deed of trust and mortgage. Like real estate, there is a solid asset underling the contract, but the enforceability and security of that asset can vary based on the note position as well as the loan to value (LTV) ratio between the note and the property. The higher the LTV, the greater the risk, especially if there is a drop in property values such that the property may be worth less than the outstanding loan.

Notes are also a type of investment that can produce excellent and consistent returns and boost the value of your tax-sheltered retirement savings. Notes come in many types, but the most common are those secured by real estate in the form of a deed of trust and mortgage. Like real estate, there is a solid asset underling the contract, but the enforceability and security of that asset can vary based on the note position as well as the loan to value (LTV) ratio between the note and the property. The higher the LTV, the greater the risk, especially if there is a drop in property values such that the property may be worth less than the outstanding loan.

Some notes hold a first position lien, while other notes can be in a 2nd or 3rd position subsequent to another note. These subordinate notes clearly come with additional risk. Such notes will typically offer a higher rate of return to offset that risk, but if the note defaults and you cannot buy out the preceding note holders, you may end up losing your investment in its entirety.

It is also possible to invest in non-performing notes, with the aim of resolving the issues and converting the note to performing status or taking control of the property. As with 2nd or 3rd position notes, this is a risk/reward decision for an investor. There is a potential for higher return, but with corresponding risk and/or legal complexity.

Most IRA note investors are focusing on less risky choices such as moderate LTV short term loans for fix and flip projects or moderate 3-5 year notes secured by performing properties.

Rates of Return

Whether rental property or a notes investment will produce better return is not always a simple question to answer, and will vary from market to market and by opportunity. As a general rule, it is somewhat easier to predict the return on investment for performing notes, as the interest rate is what it is. So long as the borrower makes the payments, that interest rate will be the return on investment. If you are investing in shorter term notes, you need to factor in the down time between one note paying off and being able to deploy the capital into another investment. Investing in notes that pay 12% return will only net you 10% annual return if the money is idle two months out of the year.

With rental property, you can make assumptions for operating expenses, unexpected repairs and vacancies, but you never really know from one year to the next exactly how close reality will match your projections. Likewise, appreciation is easy to predict in long cycles, but can be more variable over the short term. And that appreciation of the asset is only potential return up until the point you actually sell a property and lock in the gain.

Overall, you should expect similar average returns for a portfolio of relatively conservative performing notes compared to clean rental properties in a desirable neighborhood. In either class, you can change the risk reward levels, so when comparing options, be sure to consider where on the risk spectrum each choice may sit.

The Tax-Efficiency Myth

Many pundits in the real estate investing sphere promote the concept that they will only invest in notes with a self-directed IRA and not in rental property. The logic for this is that real estate can be very tax favored when done personally, and that one is giving up those tax-benefits when investing in real estate using a self-directed retirement plan. While that may be true, it is logic that entirely misses the point of investing IRA capital.

Many pundits in the real estate investing sphere promote the concept that they will only invest in notes with a self-directed IRA and not in rental property. The logic for this is that real estate can be very tax favored when done personally, and that one is giving up those tax-benefits when investing in real estate using a self-directed retirement plan. While that may be true, it is logic that entirely misses the point of investing IRA capital.

Do I care if I am foregoing tax benefits if my IRA is returning 13-15% returns each year while being deployed into a secure asset? The tax status of the IRA is what it is, and will always be different than the tax status of any investment made personally. The IRA money needs to be invested, and I want to find the best mix of security and consistent performance. If a rental property investment provides the best overall opportunity, then I will take that opportunity.

The tax efficiency issue may only come into play for an investor with significant personal holdings in real estate. In that case, it may make sense to focus the IRA on other investments such as notes, to create diversification. Put the tax-efficient asset on the taxable side of the equation and the notes inside the tax-sheltered vehicle.

Return on Investment is Always the Bottom Line

When it comes to evaluating whether to invest your IRA into notes or rental property, several individual factors will play into that decision. An investor who has experience in rental property and a proven business model (or contacts with providers of the same) will naturally lean towards putting their IRA to work in that fashion. Someone who is very busy, does not have expertise in landlording, or lives in a market where properties are too expensive and/or do not cash flow well may prefer notes.

All things being equal, one should evaluate the various rental property and lending opportunities available and see what option provides the best reward relative to the risk involved.

As I mentioned previously, sometimes the right answer is all of the above.

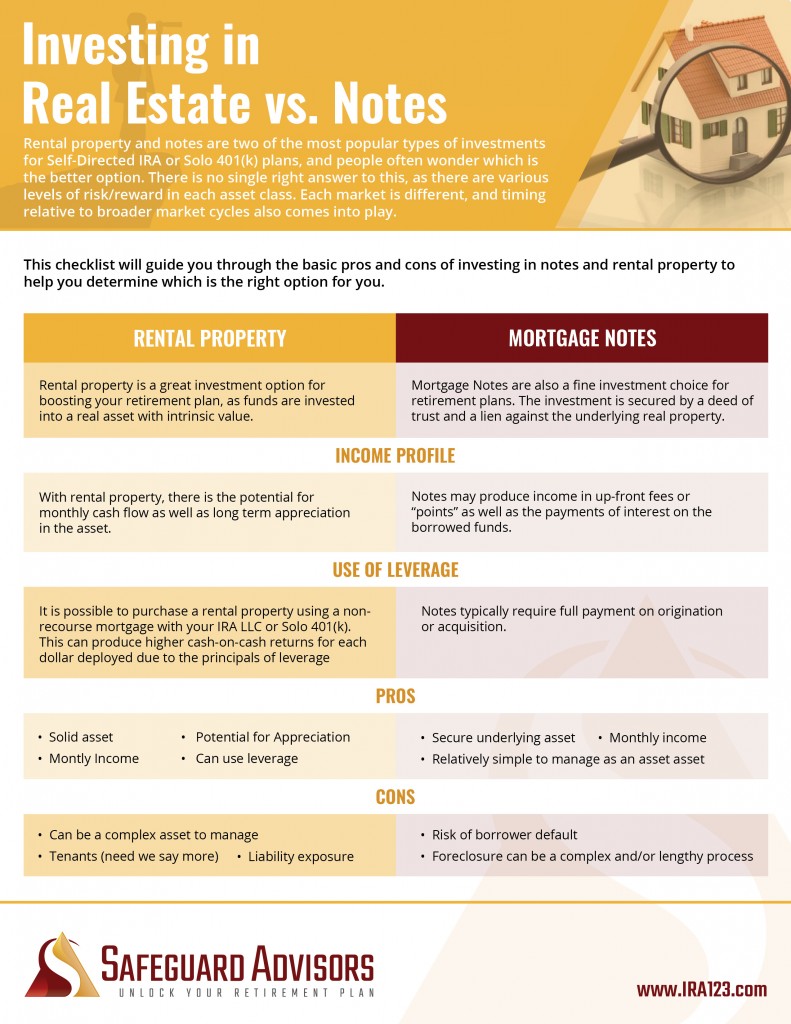

Download our two-page rental property vs. mortgage notes checklist to learn more about

the pros and cons of investing in either options

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.