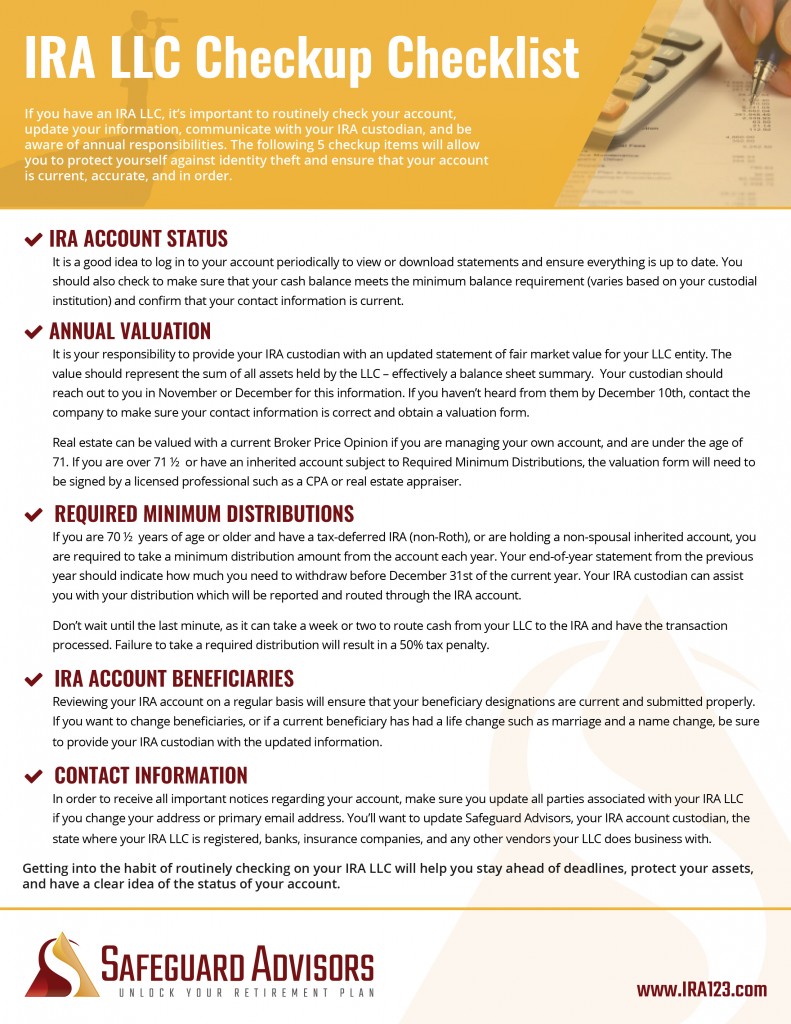

Self-Directed IRA LLC Checkup [CHECKLIST]

If you have an IRA LLC, it’s important to routinely check your account, update your information, communicate with your IRA custodian, and be aware of annual responsibilities.

If you have an IRA LLC, it’s important to routinely check your account, update your information, communicate with your IRA custodian, and be aware of annual responsibilities.

The following 5 items will allow you to protect yourself against identity theft and ensure that your account is current, accurate, and in order.

IRA Account Status

- Log in to your account periodically to view or download statements and ensure everything (including your contact information) is up to date.

- You should also check to make sure that your cash balance meets the minimum balance requirement.

Annual Valuation

- Provide your IRA custodian with an updated statement of fair market value for your LLC entity.

- Your custodian should reach out to you in November or December for this information.

- If you haven’t heard from them by December 10th, contact the company to make sure your contact information is correct and obtain a valuation form.

- Real estate can be valued with a current Broker Price Opinion if you are managing your own account, and are under the age of 71.

- If you are over age 72 or have an inherited account subject to Required Minimum Distributions, the valuation form may need to be signed by a licensed professional such as a CPA or real estate appraiser.

Required Minimum Distribution

If you are 72 years of age or older and have a tax-deferred IRA (non-Roth), or are holding a non-spousal inherited account, you are required to take a minimum distribution amount from the account each year.

If you are 72 years of age or older and have a tax-deferred IRA (non-Roth), or are holding a non-spousal inherited account, you are required to take a minimum distribution amount from the account each year.- Don’t wait until the last minute, as it can take a week or two to route cash from your LLC to the IRA and have the transaction processed.

- Most custodians recommend you initiate an end-of-year distribution request by December 1st to ensure processing is completed on time.

- Failure to take a required distribution will result in a 50% tax penalty.

IRA Account Beneficiaries

- Reviewing your IRA account on a regular basis will ensure that your beneficiary designations are current and submitted properly.

Contact Information

- Update all parties associated with your IRA LLC if you change your address or primary email address in order to receive all important notices regarding your account.

- You’ll want to update Safeguard Advisors, your IRA account custodian, the state where your IRA LLC is registered, banks, insurance companies, and any other vendors your LLC does business with.

Getting into the habit of routinely checking on your IRA LLC will help you stay ahead of deadlines, protect your assets, and have a clear idea of the status of your account. Download the full checklist below for more information.

This page has been updated to reflect law changes implemented with the SECURE Act of 2019.

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.