Steering Clear of Prohibited Transactions in a Self-Directed IRA [CHECKLIST]

Looking to diversify your investment holdings? Consider a self-directed IRA.

Self-directed IRAs and 401(k)’s can include atypical investments, such as real estate, private placements, trust deeds, and even gold and silver coins. If you are considering a self-directed IRA plan, however, you should be aware that the IRS has a set of stringent rules governing how self-directed IRAs must be managed. If you don’t comply with these regulations, you could face stiff penalties and fines as well as the loss of tax sheltered status on the entire IRA value. Rest assured… the rules are easy to follow if you know what they are.

Self-directed IRAs and 401(k)’s can include atypical investments, such as real estate, private placements, trust deeds, and even gold and silver coins. If you are considering a self-directed IRA plan, however, you should be aware that the IRS has a set of stringent rules governing how self-directed IRAs must be managed. If you don’t comply with these regulations, you could face stiff penalties and fines as well as the loss of tax sheltered status on the entire IRA value. Rest assured… the rules are easy to follow if you know what they are.

The key principal to keep in mind is that investments of an IRA or 401(k) must be exclusively for the benefit of the plan, and there may be no direct or indirect benefit between a plan and a disqualified party. Your only benefit is the tax-sheltering of the income received by the IRA, and your ability to save a larger amount for distribution in your retirement years – after age 59 ½.

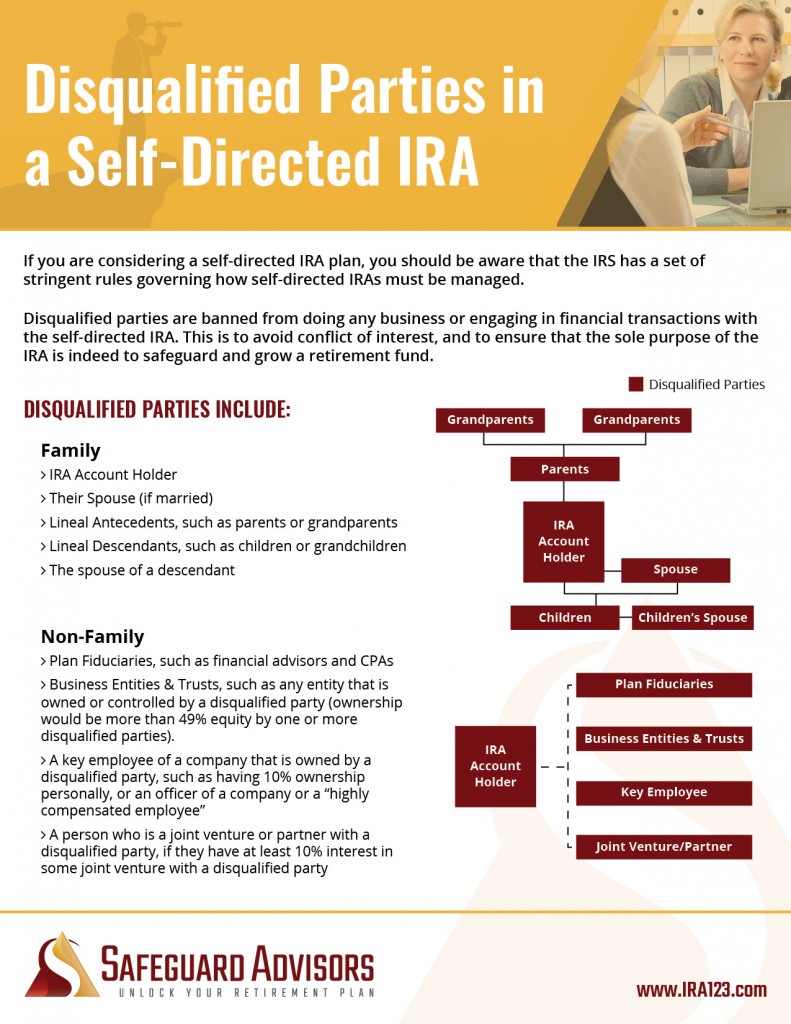

Disqualified parties are banned from doing any business or engaging in financial transactions with the self-directed IRA. This is to avoid conflict of interest, and to ensure that the sole purpose of the IRA is indeed to safeguard and grow a retirement fund.

Disqualified parties include:

The Account Holder, their spouse, and lineal family. This includes the individual who owns the IRA, i.e. the account holder, and his or her spouse and children. Lineal family such as parents, grandparents, children, grandchildren and the spouse of a descendant are also included in this category of disqualified parties.

Siblings, aunts, uncles, and other family members are generally not disqualified. However, there may be other issues that could come into play when dealing with family members. For instance, if brother holds a rental property for which you hold a mortgage with your IRA, there can be trouble if your brother cannot pay the note. Your IRA would have to foreclose, just as it would with any other borrower, or you could be looked at as having engaged in a prohibited transaction.

Plan Fiduciaries. Any person who manages the IRA account is disqualified. This also includes agents who have been hired to give financial advice or guidance to the IRA account holder such as a CPA or financial planner.

Business Entities & Trusts. Any entity (business, corporation, or trust) that is owned or controlled by a disqualified party. Ownership would be more than 49% equity by one or more disqualified parties. Control would be executive decision making power such as a director or trustee of an entity might have.

Key Employees of A Family Business

If you or disqualified parties own a business, a senior employee of that business such as a vice president or CFO would be considered a disqualified party.

Keep the list of disqualified persons front and center.

Direct Prohibited Transactions. The following examples should give you some insight on prohibited investments.

- A father sells his son a piece of property that is owned by his IRA.

- A woman leases real estate owned by her IRA to her father.

- A man lends his wife money from his IRA.

- A man lends his mother money from his IRA so that she can start a business.

- A woman buys a home with her IRA funds and lives in it herself.

- A woman owns an apartment with her IRA and hires her father for repairs.

- Lending money to your CPA

Indirect Prohibited Transactions

A transaction is still viewed as self-dealing, and therefore prohibited, if an intermediary sits between the plan and a disqualified party. Having an unrelated party purchase a house out of your parent’s estate, then purchasing from that person with your IRA would be an example of such an indirect transaction. Lending to an ex-spouse, if your minor child was living with them would also be a problem.

Property Management

One must take care when self-managing a rental property owned by their IRA or 401(k). IRS rules prohibit conveyance of benefit by a disqualified party to the plan through the provision of goods or services. The IRA account holder is allowed to administer plan investments, so things like signing contracts, paying the bills and collecting rents are OK. It would not be OK to perform repairs on an IRA owned property, however, since this provision of free labor would be the equivalent of making un-documented contributions to the IRA.

Acting as Realtor for your Plan

The IRS does not offer specific guidance on this topic, but our attorneys caution against acting as Realtor for the purchase or sale of IRA or 401(k) owned properties. Someone who is not a Realtor could execute such a transaction, as they are simply acquiring and disposing of plan assets. As a Realtor, however, one would be bringing to the table their licensing, E&O insurance, etc., and could therefore be viewed as providing services to the plan that another investor would pay for.

Prohibited Investments

IRA plans may not invest in life insurance or collectibles. A 401(k) may invest in certain life insurance contracts, but is likewise prohibited from investing in collectibles.

Items deemed collectibles would include artwork, metals, gems, alcoholic beverages, rugs, antiques, stamps, and most coins.

There are exceptions to the collectibles exclusion that allow for certain pure forms of precious metals holdings in an IRA, including:

- US minted coins of 99.99% purity – Gold, Silver and Platinum Eagles

- Foreign coins of 99.99% purity

- Pure bullion items in gold, silver, platinum & palladium, including bars and un-minted rounds.

With a self-directed IRA LLC or Solo 401(k), you can only hold the US Eagle coins. All other precious metals items must be held by an institutional IRA trustee.

In general, self-directed IRA accounts allow for a greater degree of investment flexibility and unique investment options. In order to pursue this flexibility with the confidence you need to succeed – and stay out of trouble with the IRS – you should establish your self-directed IRA with a professional team that focuses on client education and provides high quality ongoing support.

Take a look at our checklist below and download the PDF.

Photo by Ray Tsang via CC license.

Talk to An Expert Today!

Learn these little known strategies and tactics, and unlock your retirement plan today.