IRS Rules and Compliance

The IRS rules regarding the use of IRA or 401(k) funds for non-traditional investments are intended to ensure that all benefits from such activities accrue to the plan, rather than the individual. Put simply, because this money is given special, tax-sheltered status, you cannot personally benefit, other than by knowing that you are growing your retirement savings.

Understanding the rules governing IRA funds is critical to your ability to get the most out of your plan without creating exposure to tax penalties, but this can be a difficult prospect. IRS guidelines are not exactly notorious for clarity and easy comprehension. At Safeguard Advisors, one of our key roles is to work with you to make sure you are fully informed about the rules and how they apply to your intended investments.

This section of our blog is designed to help you navigate the often complex IRS rules and compliance guidelines and ascertain how they will affect your self-directed IRA or solo 401(k) plan investment activities. Articles in this category cover topics such as how to avoid prohibited transactions, effectively managing your required minimum distributions (RMDs), handling Roth IRA conversions, and more.

A Solo 401(k) is a fantastic way for small business owners to save for retirement. With high contribution limits typically ten times those of an IRA, both tax-deferred and Roth savings features, and even the ability to borrow from the…

Investing in real estate is a great way to diversify your tax-sheltered retirement savings. Real estate is not subject to the same types of news-driven volatility as stocks and provides income both through cash flow and the potential for appreciation. …

On January 1, 2024 a new federal requirement called the Corporate Transparency Act (CTA) becomes effective. Most new and existing businesses will be required to file a Beneficial Owner Information Report (BOI report) with the Financial Crimes Enforcement Network. FinCEN…

When building your retirement savings with self-directed IRA or Solo 401(k), it is not just about how you invest. Making new contributions to your retirement plan is a crucial aspect of creating long-term wealth with these tax-sheltered vehicles. As the…

Since the Consolidated Appropriations Act of 2023 was signed by President Biden on December 29, 2022, we have been reviewing the details. At over 350 pages, there is a lot to sort through. The omnibus budget package consolidated retirement rules…

On December 29, 2022, President Biden signed the Consolidated Appropriations Act of 2023. The act includes over 350 pages of new retirement plan rules that comprise the much-anticipated SECURE Act 2.0. SECURE 2.0 implements a long list of significant changes…

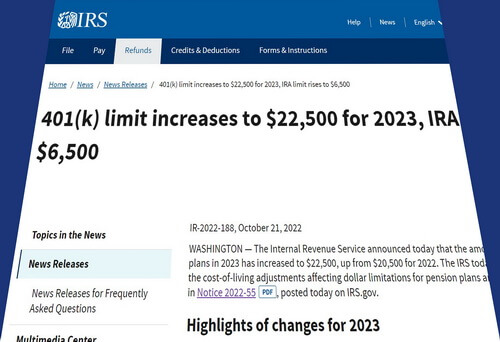

The IRS on October 21st announced updates to IRA and 401(k) contribution limits for the 2023 tax year. The increases are some of the biggest in years and impact all investors from those with a contributory IRA to participants in…

One of the benefits of the Solo 401(k) is the ability to borrow from the plan. As a qualified employer 401(k), a Solo 401(k) can issue a participant loan — just like a larger employer 401(k) style plan. For the…

Self-directed IRA and Solo 401(k) plans offer tremendous flexibility and investment choice. When you have a wide range of options, you can choose to invest in what you know best. What better way to protect and grow your retirement…

The IRS on November 4th announced updates to IRA and 401(k) contribution limits for the 2022 tax year. While individual IRA limits were not increased, savers with a Solo 401(k) or SEP IRA linked to a business will have the…