Self-Directed IRA Plans

Self-Directed IRA LLC plans offered by Safeguard Advisors open up an entirely new realm of investing possibilities for your retirement funds. With these plans, you can invest in anything the IRS rules allow for, and you can be in direct control of all your plan’s investment activities.

The IRA-owned LLC format we create provides several advantages with respect to investment flexibility, ability to react quickly to opportunity, and asset protection for your retirement savings. Because you control the LLC that is owned by your IRA, and can directly transact via the LLC bank account, there is no need for 3rd party review, processing delays or per-transaction fees. For many types of investing, this direct control is not only a big advantage, it is a necessary component of being able to execute your strategy effectively and efficiently.

This section of our blog covers topics related to the plans themselves and how they operate, such as deciding which self-directed retirement plan is best for you, shielding your IRA from liability, naming beneficiaries, and much more.

The great thing about a checkbook IRA is that it puts you in direct control of all investment transactions. This is accomplished with a two-layered structure involving an IRA with a specialty “self-directed” IRA custodian that then invests into a…

Investors who establish a self-directed IRA LLC are primarily focused on the ability to invest in non-traditional assets such as real estate, trust deeds, and the like. But what if you want to invest in conventional financial products like stocks,…

In a recent article we discussed the critical layer of asset protection afforded by the Checkbook IRA LLC structure. While it is great that the LLC entity in this plan format shields the IRA and the IRA account holder from…

We are excited to roll out a big change that will greatly streamline the bank account setup process for new checkbook IRA and Solo 401(k) plans. Starting June 1, 2023, Safeguard Advisors will offer concierge banking setup with Solera National…

A self-directed IRA, with its expanded options for investment choices, can be a great tool for creating wealth. Protecting that wealth is just as important as building it. Fortunately, there are steps you can take to mitigate risk in your…

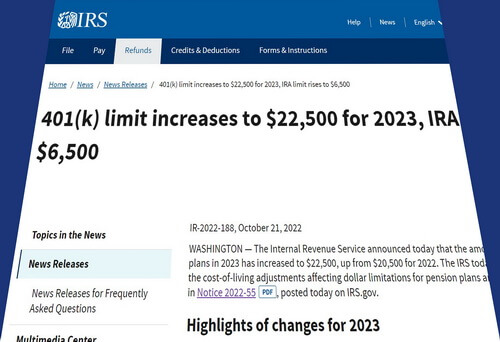

The IRS on October 21st announced updates to IRA and 401(k) contribution limits for the 2023 tax year. The increases are some of the biggest in years and impact all investors from those with a contributory IRA to participants in…

A Checkbook IRA is a great tool for unlocking your retirement plan and taking control of your investments. Whether deployed as an IRA LLC or IRA Trust, the point of the structure is to give you as the IRA account…

A self-directed IRA or Solo 401(k) plan that offers checkbook control can have many advantages over a similar plan offered by a 3rd party custodian serving as a processor. When it comes to investing in real estate, the benefits that…

As tax season rolls around each year, we typically get a lot of questions about tax filing requirements and where to find a CPA who can help. The simple answer is that most self-directed IRA and Solo 401(k) investors will…

The IRS on November 4th announced updates to IRA and 401(k) contribution limits for the 2022 tax year. While individual IRA limits were not increased, savers with a Solo 401(k) or SEP IRA linked to a business will have the…