Industry News and Economic Trends

Part of planning any successful investment strategy is taking time to understand the “big picture.” Paying attention to industry news and larger economic and demographic trends can yield useful information for evaluating the long-term viability of various investments.

When you are aware of what is going on in the industry, you will be able to assess how your chosen market is acting relative to other markets and regions across the country, identify markets outside your local area that may present opportunities, and stay on top of any economic trends that may have material impact on your investments. For example, say you are interested in a property because the price is very low and it looks like a good investment at face value. Evaluating trends in the number of vacant properties and average time to fill a vacant rental before you make your purchase can be critical to your investment’s success. Property purchased at a bargain rate does not ensure success if you cannot find a renter. Stated simply, being in the know will help you stay a step ahead in the investment market.

This section of our blog focuses on keeping you up to date with current industry news, recent economic trends and reports on the state of the economy in relation to its potential impact on your investments.

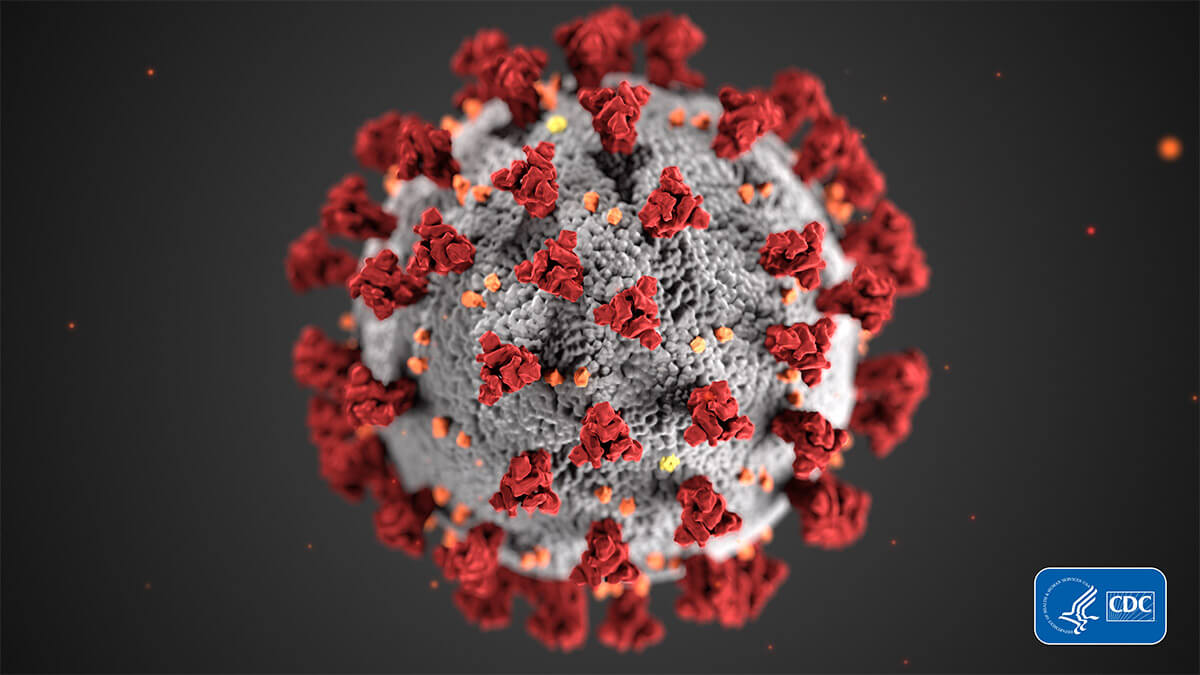

As we begin a new year, we can hopefully look in the rear-view mirror at the bleak reality that the coronavirus pandemic made of 2020. There are still many steps to recovery, but with vaccines now in use, we can…

In the last half of 2020, the Securities and Exchange Commission implemented two significant changes that will expand access to capital for business and allow a broader array of investors to participate in a variety of private offerings. These changes…

The Coronavirus pandemic is a big fat pile of lemons that life threw at us. Who’s ready for some lemonade? For all the negatives associated with COVID-19 and corresponding economic shutdowns, the positive is that for many investors there is…

As a response to the expanding COVID-19 pandemic and the significant impact it is having on our economy, congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act in late March. Within this wide-ranging law, there are several changes…

The 2019 year-end domestic appropriations bill included the Setting Every Community Up for retirement Enhancement Act (SECURE ACT). The SECURE act contains several substantive changes to IRA and 401(k) based retirement plans. While the law makes changes in a range…

As part of the 2019 year-end domestic appropriations bill, a significant package of rule changes for IRA and 401(k) based retirement plans known as the Setting Every Community Up for retirement Enhancement Act (SECURE ACT) was included. This act passed…

One of the most consistently popular investment choices for IRA investors is real estate. Many retirement investors put their personal knowledge and experience with real estate to grow their retirement savings. And a big part of what makes an IRA real…

In an industry as competitive as real estate investing, you’ve got to equip yourself with as many tools as you can to stay one step ahead of other investors. Staying on top of real estate market trends is always top-of-mind…

If you are using your IRA or Solo 401(k) to invest in rental properties, you will appreciate the benefits of the smartphone app Centriq. This free program allows you to easily track various components and documents associated with a property…

As real estate investors, we need to look at both short-term and long-term cycles and trends, as well as national, regional and local market dynamics when evaluating opportunity and risk. We also need to make some (hopefully educated) guesses about…